Thursday, March 24, 2005

www.movermike.com

Monday, March 21, 2005

John Maudlin Outside the Box

Two weeks ago we noted that the biggest factor which was holding down the yields in US and European bond markets was the price-insensitive buying by three investors groups: Asian central banks, Western pensions and insurance funds and, most importantly, Japanese private investors.In the column he also notes

The Nikkei and the US bond yield have been moving in tandem for most of the last decade. The correlation of daily movements in these two markets has been 90% since 1990 and 92% since 1996. Intriguingly, the correlation between the Nikkei and the US bond market has been much closer than the correlations between US and Japanese bond markets or between bonds and equities within either Japan or the US.I took a look at the P & F chart of the Nikkei since Feb., 2001, and it appears that the nikkei has completed a large base and a move through 12,000, would signal higher prices for the Nikkei and if the correlation holds, higher treasury bond interest rates for the US. Not good news for interest-rate sensitive corporations and consumers. Below is the P & F chart courtesy of StockCharts:

One more chart: This one shows how the financial stocks are acting. They appear to be anticipating higher interest rates. (Hat tip to Richard Russell's Dow Theory Letters)

Mover Mike

A Day of Hat Tips!

and Redevelopment has some people on uneasy street in San Diego.

They fear the city might resort to eminent domain if they refuse to sell their properties to make way for what some officials describe as the most significant redevelopment project proposed for Midway.Mover Mike

The proposal includes 124 condominiums in an area where civic leaders have lamented a lack of residences.

This week's Carnival of the Capitalists is up!

Mover Mike

I have started a new blog, Landfair Furniture which will be devoted only to items of interest to entrepreneurs, interior designers, people interested in home improvements and home decor, marketing, retail, and interviews with top Portland, Oregon interior designers.

Mover Mike

Yesterday, I posted about Muslim parents agitating for Islam to be taught in the public schools. Today, Milt's File has found an excellent article in the Middle East Quarterly titled The Muslim Brotherhood's Conquest of Europe

First Germany, Then Europe

While the Muslim Brotherhood and their Saudi financiers have worked to cement Islamist influence over Germany's Muslim community, they have not limited their infiltration to Germany. Thanks to generous foreign funding, meticulous organization, and the naïveté of European elites, Muslim Brotherhood-linked organizations have gained prominent positions throughout Europe. In France, the extremist Union des Organisations Islamiques de France (Union of Islamic Organizations of France) has become the predominant organization in the government's Islamic Council.[69] In Italy, the extremist Unione delle Comunita' ed Organizzazioni Islamiche in Italia (Union of the Islamic Communities and Organizations in Italy) is the government's prime partner in dialogue regarding Italian Islamic issues.

Mover Mike

Sunday, March 20, 2005

BCE, CE, and Christianity

The artifacts from indians on the Columbia river and later artifacts from the Etruscan and Roman empires are all dated "BCE" or "CE". We asked one of the curators as we were leaving, "What's with the BCE and CE?" Didn't it used to be "BC" and "AD"? Turns out it did. Seems some groups were upset with "Before Christ" and "Anno Domino - In the year of our Lord" . Now artifacts are labeled Before the Common Era (BCE) or Common Era (CE). It's the same dividing line between BCE and CE as BC and AD. I don't know how they explain that!

Isn't it ironic. It's the athieists and others who have succeeded in ridding the schools of God, yet in Europe, Muslims are agitating the public schools to include Islam instruction in the schools so the children don't lose the Muslim heritage. Well, damn, I'm afraid my grandkids will lose their Judaic-Christian heritage!

Mover Mike

Speaking of Christian, when I was a kid, one might be asked , "Do you go to church?" or "What church do you belong to?" I was brought up Methodist and took classes to become a member of the Montavilla Methodist Church. The minister was Mr. Wilson, whose son (a true preacher's kid) and I shared classes at Vestal Grade School. Later, my parents and I attended the Unity Church, kind of a stripped down church, concentrating more on the teachings of Jesus and less on the rituals. I remember a girl I was seeing who was Baptist. She was afraid I was attending the Unitarian Church and before I could date her, further, her parents wanted to make sure I believed in The Trinity. I swear I had to be coached to know what The Trinity was.

I remember one time I saw some kind of religious movie at the Hollywood theater. At the end of the movie every one in the audience was invited to come down front to "accept Jesus Christ as my Personal Savior". I know I sat there for some time debating whether I should get up out of my seat, in front of everyone sitting, and go down front. In the end I did and wondered if my life would change somehow. I looked for signs for some time. I don't recall that it was a life changing experience for me.

The other day I was asked, was I a Christian? This to me is almost like a slap to the head with a wet washrag, it's so personal. "Of Course!", I answered. Somehow, I wonder, if life changed. When did we drop the awareness of religion and a church and simplify to just Christian, I suspect it may have had something with Dr Robert Shuler and his Crystal Cathedral. It apparently is non-denominational, just teaches the power of Christ.

I also wonder if the question, "Are you a Christian?" is code for "Are you "born again"? I had an uncle I liked a lot die, last year who was very active in his church, The Church of the Nazarene. I guess that this church is similar to being an orthodox Jew, pretty conservative. My uncle would have a conversation with anyone and everyone. He never failed to ask during the conversation, "have you accepted the Lord Jesus Christ as you personal savior?"

Where's that wet washrag?

I have been blessed with a wife who loves me, children who love me and blessed with two grand kids. My parents are both alive, as are Bev's. I don't anticipate we'll be eating cat food in our retirement years. I try to discover God's will for me. All I know, is that my higher power has been with me, giving me strength through the hard times and filling me with love and graditude in the good times.

Mover Mike

Saturday, March 19, 2005

Market Value vs. Total Debt

| Dow Jones Industrial Average Plus Three | | | |

| Company Symbol | Mkt Value | Total Debt | Company |

| MMM | 66.6 Billion | 2.82 Billion | |

| AA | 27.6 | 6.30 | |

| MO | 133.9 | 22.98 | |

| AXP | 65.4 | 47.24 | |

| AIG | 155.7 | 91.70 | |

| BA | 47.6 | 12.20 | |

| CAT | 32.9 | 23.53 | |

| C | 244.4 | 448.43 | Citigroup |

| KO | 53.2 | 7.18 | |

| DD | 99.9 | 6.48 | |

| | | | |

| XOM | 400.0 Billion | 8.29 Billion | |

| GE | 380.3 | 370.91 | Gen. Elec |

| GM | 16.9 | 300.00 | Gen. Motors |

| HPQ | 58.2 | 7.21 | |

| HD | 85.4 | 2.15 | |

| HON | 32.7 | 5.27 | |

| INTC | 145.8 | .90 | |

| IBM | 145.8 | .77 | |

| JPM | 128.0 | 303.21 | JP Morgan Chase |

| JNJ | 200.0 | 2.85 | |

| | | | |

| MCD | 40.6 | 9.22 Billion | |

| MRK | 70 8 | 6.87 | |

| MSFT | 264.5 | 0.00 | |

| PFE | 192.7 | 18.55 | |

| PG | 134.7 | 23.25 | |

| SBC | 77.1 | 26.97 | |

| UTX | 53.1 | 5.59 | |

| VZ | 97.4 | 39.27 | |

| WMT | 217.9 | 31.45 | |

| DIS | 57.5 | 13.71 | |

| | | | |

| FNM | 53.2 | 939.67 | FannieMae |

| F | 20.9 | 172.97 | Ford |

| DCX | 45.6 | 99.52 | Daimler Chrysler |

General Motors

GM has $300 billion in debt ...and has a market cap, now, of $16 billion. See the problem there? The bondholders could buy the company nearly 20 times over if they used their money to buy stock instead of loan it to the company. The implication is clear--that GM is headed towards bankruptcy, and will default on the bondholders, who will then own a company worth less than $16 billion dollars!In addition to long term debt there is a significant longer-term challenge posed by the company's large retiree base and the resulting high level of health care costs.

For every one point that interest rates rise, refinancing GM's debt will cost an additional $3 billion in annual interest payments -- money that they clearly do not have! Where is GM going to get another $3 to $6 to $9 billion as interest rates rise by 1%, 2%, and 3% more? Selling cars? Nope. Selling stock? Unlikely in this market! Borrowing more? From whom?...snip...

So, therefore, GM will soon be a $300 billion dollar blow-up!

How big is that? It's bigger than Enron, Global Crossing, LTCM, K-Mart, and the IRAQ war all put together!

At year end 2003 GM's unfunded OPEB liability was $57 billion (exculding the $4 billion Medicare subsidy), and annual health care costs approximated $5 billion. Moody's believes that this burden will represent an increasingly material competitive disadvantage for GM as health care costs continue to rise.From The Pension Catastrophe by Gary North

The problem facing every company with a defined benefit program is that current pension obligations must be factored into retail prices. Consider the auto industry.

... The results of a Prudential Financial study state that pension and retiree benefits represent $631 of the cost of every Chrysler vehicle, $734 of the cost of every Ford vehicle, and $1,360 of the cost of every GM car or truck. In contrast, an article in the Detroit Free Press reported that pension and retiree benefit costs per vehicle at the U.S. plants of Honda and Toyota are estimated to be $107 and $180, respectively."...snip...

But costs do not determine prices. Supply and demand determines prices. If a new supplier comes along who is not burdened by past pension fund obligations, this supplier can undersell the firm that made such promises. For American and European firms, the four-letter word that confronts them is "Asia."

Friday, March 18, 2005

Eminent Domain in Freeport, Texas

But as philosopher Ayn Rand observed, "there is no such entity as 'the public,' since the public is merely a number of individuals . . . .the idea that 'the public interest' supersedes private interests and rights can have but one meaning: that the interests and rights of some individuals take precedence over the interests and rights of others."In Freeport, Texas, a Brazoria County coastal town has big plans to develop a marina to bring in money to the city... some residents say all that money will go to the developer and not the community, says News2Houston Investigators.

None of "who gets the money" matters. What matters is a local government wants to force two businesses to sell their land to build a private yacht marina, backed with a $6 Million loan from the local government. For 50 years, loads of Texas gulf shrimp have been bagged and stacked at Western Seafood in Freeport. Wright Gore, of Western Seafood, was asked to sell by the developer and refused. So the developer went to the local government and asked them to use their power of eminent domain to force the sale. The city felt that the public interest was served by "best use" of the property. Both Western Seafood and Trico Seafood have filed a federal lawsuit against the city of Freeport and the Freeport Economic Development Corp. to stop the land acquisition.

Do you have other examples of Eminent Domain gone amok? (hat tip to T F Stern's Rantings

Mover Mike

Thursday, March 17, 2005

How Do I Own Gold?

If you owned a Gold coin and you sold it this afternoon you would sell it for $447. If I recall correctly, when I started buying, the sell price or bid was equal to the price of Gold. It appears to have changed. Now, you may find that some dealers charge less than 4.61%, I don't know. AJ & PT was convenient for me and their web site has quotes that are updated throughout the day.

Owning Gold Coins is not for speculation, this is insurance! I would guess that most financial planners would recommend 5% of ones investible assets to be in Gold. I believe gold will sell between $1500 to $5000 per ounce. I believe the DJIA and Gold will trade at the same level. I don't know when and I don't know what the US will look like. I expect prices of everything to be up 3 to 10 times in dollars. The ATM's may be shut down and the only money you have is your gold. This is insurance only.

I buy shares in Gold mining companies for speculation. There is huge leverage in the mining industry. The price of Gold can go up 20 fold, but not your costs. The earnings can explode and in a fever, other speculators will pay rediculous prices for the shares. Do your homework, but absolutely do NOT buy any hedger like American Barrick. IMO, they will be bankrupt when the derivatives that they have sold against their reserves are called. With both the coins and shares, put them away in the famous "lockbox" (I didn't say safety deposit box!) and forget about them until the fever rises. There is no fever like Gold fever!

The Asian and Indian people fully understand how Gold is used for protection. You would think we would, also. We were warned by our Founding Fathers to protect our currency with metal backing. We have experienced our currencies being worthless; the Continental and the Confederate currency. Yet, owning gold seems such a foreign thing to do. Always glad to answer any questions.

Mover Mike

Parmalat

Prosecutors investigating the Parmalat scandal have accused four foreign banks and an Italian asset management firm of helping the dairy foods giant mislead investors, moving closer toward a possible trial. In the report, seen by Reuters, the prosecutors also accused 13 bank executives, including an employee of Credit Suisse First Boston of the Italian crime of market-rigging.Mover Mike

Parmalat collapsed under 14 billion euros ($18.7 billion) of debt in late 2003, triggering one of the world's biggest financial scandals.

Eminent Domain, Again

Our land, particularly the best-located land, is a common asset on which we are all dependent. Allowing individuals or corporations to occupy it without compensating the rest of us (the public) for its value is the underlying problem...What Achenbaum is saying, in my words, is if through progress or fluke the land you live on becomes valuable, more valuable than its present use, say as your home, it is not only a problem, but an argument for the use of eminent domain.To such government officials, the fact that an individual earns a piece of property and wants to use and enjoy it, is of no importance--all that matters is "the public."

But as philosopher Ayn Rand observed, "there is no such entity as 'the public,' since the public is merely a number of individuals . . . .the idea that 'the public interest' supersedes private interests and rights can have but one meaning: that the interests and rights of some individuals take precedence over the interests and rights of others." In the context of the Kelo case, the idea that "the public interest" trumps private property rights simply means that the desires of some individuals for property they did not earn and cannot get from others voluntarily trump the rights of those who did earn it and do not want to sell it. Why are their rights trumped? Because some gang with political pull doesn't happen to like how these individuals are using their property.

From Capitalism Magazine

Individual rights protect man's freedom -- freedom from the coercion of others -- to pursue his life and happiness in the only way he can, by following reason. Initiating force against another, by its vary nature, is anti-reason and therefore anti-life. This is what our mainstream intellectuals and politicians obscure, evade and oppose when they advocate the violation of individual rights.If we do not keep defining, in a different way each time, the values of freedom and personal property rights, I feel we will lose them. There seems to be a constant and consistent effort to erode or chip away at these concepts.

When a collectivist claims that individual rights must be subordinated to the "public good," his concept of "public" is divorced from individuals, and his concept of "good" is divorced from reason, freedom and justice. His claim amounts to: The needs or desires of some necessitate the enslavement and destruction of others.

Mover Mike

Double Digit Price Increases

SGL Carbon to increase prices for carbon fibers and carbon fiber products

Wiesbaden, March 17, 2005. SGL Carbon’s business unit SGL Technologies announces price increases across its carbon fiber products range with immediate effect. The double digit percentage increases vary from product to product and will affect the Company’s carbon fibers as well as fabrics, prepregs and other fiber-reinforced matrix products.

Jan Verdenhalven, Managing Director of SGL Technologies commented: "These price increases are based on raw material cost increases as well as on continually tightening demand and supply situation in the carbon fiber markets.”(emphasis added)But Larry, there is no inflation!

Mover Mike

Wednesday, March 16, 2005

GM

(This is the chart I tried to get in yesterday, but I couldn't make it work.)

I'm told that GM sales in the Northwest were down 60% the last three months. I also understand that GM, Fannie Mae, AIG, and JP Morgan have trillions of derivatives, many think this is just an accident waiting to happen.

GM is currently rated BBB- at S&P, the last investment grade rating, and Baa2 at Moody's, two notches above junk. There is speculation that GM's credit rating will be downgraded to junk following this morning's reduction in guidance.GM has more than $100 Billion of debt outstanding. Sellers of bonds could swamp the bond market if they were forced to sell because of a downgrade. "What's good for GM, is good for the country!" So goes an old saying, for you newbies.

Mover Mike

Hey Larry Kudlow, just saw a chart that shows the Gold/CRB ratio going back to 1993. Looks like the 1.60 times the CRB is about the pivot point, mostly it trades at 1.6, some times it swings down to 1.20 sometime over 1.80. Right now the CRB is at 322; 1.6 times the CRB equals a price of gold at $515. I'm guessing that one of your alarms is going off soon!

Mover Mike

Dreaming of the other side of the wire

We all agree that we have an immigration problem. We have 1 to 3 million (estimates vary widely) immigrants, predominately from Mexico and south coming to the US. We offer a minimum hourly wage that is equal to a days pay in Mexico. We offer jobs, health care and citizenship to those born here.

No one will allow the 10 Million or so here now to be deported. That would be like setting up concentration camps in Mexico. However, the states on the border are having to pay some outrageous costs that are the nation's costs, it seems to me, not just the states. President Bush has proposed something like workers passes, where a Mexican could go back and forth easily. That seems to me, like a reasonable start. I do have several problems with the situation as it is now.

The "Boat People" came here defying terrible survival odds seeking asylum. They had to jump through all the usual hoops to be granted citizenship. They earned it by studying our values and passing a test and having some proficiency in the English language. It is not fair to these people to grant blamket amnesty to people from the south of our borders.

I object to the multicultural atmosphere of the immigrants. They set up enclaves of like minded people and non english signs on their businesses and don't attempt to fit in. I was amazed to see a woman in traditional Muslim dress, get into a SUV, and drive away while talking on the phone. When you come to the US, act like an American. Don't come here and create the same conditions here that drove you from your lands.

Ex Governor Dick Lamm listed some ways to destroy America. One of those was to

Make our fastest growing demographic group the least educated.We will need to see that these immigrants are educated and they inculcated with our values and we will need to agree on those values.

Mover Mike

Furhman writes that union janitors at the Detroit Airport are unhappy because they are being replaced by Non-union janitors. And in Fuhrman's opinion

If I were to try to rank airports by their cleanliness, I'd put the Detroit facility last and in a class by itself. The Miami airport sometimes comes close but doesn't really compare. How do I rate them? I go to the bathroom. When I'm in Detroit, I'd rather relieve myself behind the Northwest commuter terminal in subzero weather than sit down on any toilet in the complex. There are diseases there that are intermingling and creating uncatalogued pestilences. If a pandemic begins to spread across the land, it will originate in Concourse B at Detroit Metro. Mark my words.Now here's my question: IF metro germs can leap five feet, can they swim up stream, so to speak, as I relieve myself in the Detroit Airport or any other airport for that matter? There's that picture of the Salmon! Would it be better if I stood back 10 feet from the urinal?

I remember reading this warning on a stall wall:

It Does No Good To Stand On The Seat.

Metro Germs Can Leap Five Feet.

Mover Mike

The Grumpy Old Bookman writes about something I've long suspected. Most people don't read the short stories that are widely touted in some of our trendy magazines, just as, I suspect, they don't read the poems. However they are praised by acedemics, those who adfminister the MFA programs. Read Part 1. The official history of the short story and tomorrow the real story.

Mover Mike

IBM, Whitley Strieber

IBM has shown off a working prototype of a ultra-high density storage technology that could cram in the equivalent of 25 DVDs in a space no larger than a postage stamp.Wow, a camera that could hold the equivalent of 25 CD's of pictures on a postage-stamp sized memory card. Now if they could just invent a battery that would last...to take those pictures!

Mover Mike

Whitley Strieber at Whitley Strieber's Unknown Country has an update to the book "Superstorm" he co-authored with Art Bell on which the movie "The Day After Tommorow" was made.

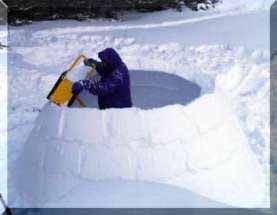

Unfortunately, we are in a time of horrific crisis far beyond anything I imagined when Art Bell and I wrote Superstorm. It is so much worse than I expected then that I almost can't believe what I am seeing. We are well into a sudden climate change situation, but it may not be the one that we envisioned in Superstorm.I thought of him today for two reasons. He claims Mount Kilamanjaro losing its snow cover is one more piece of evidence for global warming. Today, however Betsy's Page credits The Astute Blogger for presenting other ecidence besides global warming for the disappearance. The second reason, while reading my feeds from Bloglines, I discovered Kevin Kelly at Cool Tools has a tool for sale that helps you build Igloos. Called the Iceblox, it sells for $176. Might be just the thing we should get on the net and order.

Mover Mike

From Bloomberg, Oil at an all time high, above $56 per barrel, CRB at another high of 322!

Mover Mike

Tuesday, March 15, 2005

Hitchens on NYT and SBV's

Mover Mike

In The American Enterprise Online is an interview with John O'Neill of the Swift Boat Vets. At a May 4th press conference calling John Kerry Unfit to be Commander-in Chief, his group was shocked that the major media did no reporting of the event.

Our analysis after the press conference was that the three major networks, the New York Times, and the Washington Post would under no circumstances carry a story like ours, no matter how well documented.(Hat tip Free Republic and Polipundit)

Mover Mike

Monday, March 14, 2005

Steel Prices, Iran, and Gold

Current prices are likely to be revised in April. Steelmakers have raised prices to automakers by 5-10% over the past 2 years. Latest increases will raise prices to levels seen prior to the nearly 30% reduction that took place after NSANY began cutting costs in 1999.But there is no Inflation!

Mover Mike

Iran signs 3 billion euro cooperation protocol with Italy.

Iran and Italy signed an economic cooperation protocol worth three billion euros here Thursday night, based on which the Italian government is urged to provide Tehran with industrial machinery upon request, in return for Iranian oil.What, no mention of USD's! Every agreement that is signed will make it harder for the US to pressure Iran to give up nuclaer weapony.

Mover Mike

Here's Saw an interesting chart showing the relationship between the price of Gold and the price of Oil. You can see In the late '90's Gold was 25 times the price of Oil, 15 times is probably the mean for 30 years, and today it is 8 times! The last time it traded at 8 times was in 2001, when Gold was about $250 per ounce.

IMO, we will see Oil at 100-120 per barrel. We know that the mine supply of physical gold is in deficit of 40% compared to world demand (roughly 2,500 ton mine supply vs. 4,500 ton annual demand) and the mine supply is decreasing each year. At 8 times Oil, Gold will sell at a minimum of $800 per ounce.

Mover Mike

Hillary Gets Tehran Apologist's Backing

WorldNetDaily.com Exclusive By Art Moore Tehran apologists backing Hillary?

Iranian Americans accused by members of their community of collaborating with the cleric-led Islamic regime in Tehran have planned a fund-raiser for Sen. Hillary Clinton in the San Francisco Bay Area.Mover Mike

From WorldNetDaily.com Lebanon: Syria out, Iran in By Aaron Klein

As Syria prepares to withdraw some of its troops from positions in Lebanon, Iran has been fortifying Hezbollah bases and positioning itself to become the dominant force on the ground in Lebanon, senior opposition sources say.I suspect, Israel will feel more threatened and as the heat has been turned up for freedom in Lebanon, we will have more incentive to act against Iran.

Mover Mike

Sunday, March 13, 2005

Philip Bennett and the People's Daily of China

Yong Tang: According to the opinion polls, the image of America has been becoming less and less popular in the world today since after the Iraq war. As a top leader of a major American newspaper, how do you think of this growing anti-American sentiment?Bennett: ...the US government and Bush administration reacted by deciding that the country would make decisions in foreign affairs that respond only to US interests. They were not going to consult very widely, and not to compromise in making those decisions. That caused rift even among the US allies. So it is natural to see that the image of America is the lowest in public opinion.

But it is important for Chinese to understand that the image of America is many things, not just the image of the government. American culture, as expressed in Movies and music etc, is still quite popular in the world today. American movies are remarkably popular all over the world to the extent that you can buy them on the streets of all major Chinese cities. People don't t stop seeing US movies or buying US music just because they are unhappy with the Bush administration.

Mr. Bennett did not emphasize the point that the Bush Administration made. "We will not consult with others about issues that directly affect our survival. Some of us don't like the image we project in our movies and our music. We don't like movies that glorify abortionists or play up the image of Che Guevera, who went on to murder many innocent people, or the foul-mouthed Whoopi Goldberg, or Rap songs that are mysoginistic.

Yong Tang: In such sense, do you think America should be the leader of the world?What a statement for Bennett to make. Do we want to go back to the cold war and have powerful superpowers threatening each other?Bennett: No, I don't think US should be the leader of the world.

Yong Tang: How do you think of the roles American mainstream media play in American foreign policy?What a crock. Bennett thinks because all of his pals think like him that he has no political point of view. When a hugh percentage of his people admit voting for the Democrats, he has a point of view and it consists of consulting with the UN, and talking and talking, and passing meaningless measures with teeth, but that are never enforced.

Bennett: We have a little bit different roles in newspapers compared with our counterparts in Europe and other countries. We don't have any political point of view that we are trying to advance. We don't represent any political parties. We are not tied to any political movement. On the news side of the paper we try not to give opinions. So I think the role the Washington Post should play is to hold the government accountable for decisions made by it.

And what is wrong with being a leader? Our problem, our lack of respect stems from all the times in the past that we encouraged the oppressed to rise up and throw off their chains, and the US turn its back on their hopes and dreams. Our lack of respect stems from the times we turned tail when our blood was shed. It is hard to be the leader. A leader stands out, has courage, believes he is right, and is willing to risk failure for his ideas.

I accuse Bennett of fraternization with the enemy or at least handing a propaganda victory to the Chinese.

Mover Mike

It Just Doesn't Add Up!

In Kudlow's Money Politic$, Kudlow says:Rob Kirby in SEND IN THE CLOWNS says...we actually lost 24,000 jobs

Today’s 262,000 payroll jobs increase is yet another data point arguing that the economy may actually be speeding up in the first-half of 2005.

January Trade Deficit

Jan. Trade Deficit reported $58.3B vs. consensus $56.8B. January's trade deficit was the second largest on record and could have been much bigger but for a little jiggleing with the average price for oil that we import. Seems the government came up with a price of $35.35 per barrel almost as low as July of 2004 of $33.28 per barrel. Now take a look at this weekly chart of Light Crude and tell me how "they" arrived at $35.35. I suspect next months trade deficit will be a record.

John Embry! on Gold Price Manipulation

In the '68-'71 time, period, Embry says, western central-banks dumped 100 Million ounces of Gold to keep the price at $35 per ounce. When they failed, the price jumped 20-fold. The low in 2001 was $250 per ounce, 20-fold is a long way up there. So far the western central-banks have dumped 500 million ounces to manage the price over the last 10-12 years. But, this time eastern central-banks are buying!

Larry Kudlow argues there is no inflation. He believes the government figures of 2% or so despite the CRB going to 25 Year highs. One of his clues about inflation is revealed in this The American Spectator interview in March of 2001:

TAS: You are still largely a gold guy?To believe the government's statistics is crazy, then to prognostocate based on those nutty numbers is crazier, and to base any personal financial decisions on some "expert's" prognostications is insane.

Kudlow: Yes. It provides important information about inflation.

TAS: But is gold really relevant, with all of these currencies trading against each other? We have wonderful barometers. Why still gold?

Kudlow: It has not failed me. When gold is low, inflation is low. In 1999 and 2000 when Greenspan was wrongly obsessing over inflation, I just kept saying wake me when gold hits $300. Sure, the gold bugs are gone, the investors. But I don't want gold to be a hot investment. The minute it is, I know the rest of the story is going to fall apart.

Mover Mike

Saturday, March 12, 2005

Tampa Bay Earthquake

Mover Mike

John Embry!

In the '68-'71 time, period, Embry says, western central-banks dumped 100 Million ounces of Gold to keep the price at $35 per ounce. When they failed, the price jumped 20-fold. The low in 2001 was $250 per ounce, 20-fold is a long way up there. So far the western central-banks have dumped 500 million ounces to manage the price over the last 10-12 years. But, this time eastern central-banks are buying!

When eastern central-bank buying outstips western central-bank selling, and it will in the not-too-distant future, the other remarkably bullish fundamentals for gold will take over and drive the gold price to levels that most people can scarcely imagine today.

Mover Mike

Don Luskin, etc.

Don Luskin has a great article about inflation:

Consumer prices don't need to be rising uniformly for inflation to be a problem. They aren't, but it is. in Trendmacrolytics.

Luskin has noticed that long bonds have moved from 3.97% to 4.5%, because investors are seeing the first signs of inflation and he explains how it is working in this global economy.

Mover Mike

From Economics 101 we learned that GDP = Personal Consumption + Gross private domestic investment + Government consumption expenditures and gross investment +/- Net exports of goods and services. If we are running a negative Net exports of goods and services of $600-700 Billion per year, then our GDP is lower than it should be by about 5%+.

Mover Mike

From the PrudentBear

Last night from Dr. Bernanke: “Over the past decade, a combination of diverse forces has created a significant increase in the global supply of saving – a global saving glut – which helps explain both the increase in the U.S. current account deficit and the relatively low level of long-term real interest rates I the world today.”Kudlow are you listening? Beranke is singing your song!

Well, from the Fed’s own “Flow of Funds” we know that – “over the past decade” - Total U.S. Credit Market Debt has increased $19.4 Trillion, or 115%. Broken down, Non-financial Credit Market Debt increased $11.2 Trillion, or 86%; while Financial Sector Credit Market Debt jumped $8.2 Trillion, or 214%. What Dr. Bernanke refers to as a “global glut of savings” is actually a historic surfeit of dollar IOUs. That these IOUs are predominantly backed by non-productive assets is a huge problem. That a large amount of these IOUs are held by foreigners compounds the problem. That a significant but unknown portion of these IOUs are held or, importantly, hedged by highly leveraged financial players and speculators creates – in the words of Hyman Minsky – “acute financial fragility.”

Mover mike

Friday, March 11, 2005

January Trade Deficit

Mover Mike

CRB P&F Chart

Do you know where Gold was the last time the CRB was at these levels?

---------------------------CRB--------Spot Gold

6/30/1980--------------286.40--------647.4

7/31/1980--------------302.30--------619.7

8/29/1980--------------308.40--------635

9/30/1980--------------319.40--------671.5

10/31/1980-------------327.10--------636

11/28/1980-------------334.80--------624.6

12/31/1980-------------308.50--------591.3

(Statistics courtesy of Dan Norcini)

Here's a picture of the USD over almost the same time period.

Some say that inflation is the cruelest tax. "What do I care if the USD goes down", you say. Suppose in 2001, you planned on buying an imported car. The USD was 1.20 to the Euro and the new BMW was $20,000 $22,500. You decided the time wasn't right and now it is, in 2005. But now the USD is .8 to the Euro and the same car is now $30,000. Since the government causes inflation by printing money without anything to back it, they just picked your pocket for $10,000 $7,500, even though they lowered your taxes. They devalued your currency by 33% and you didn't even know it.

Mover Mike

Thursday, March 10, 2005

Iran and Inflation

Mover Mike

From the WSJ.Online Fed's Bernanke : US House-Price Growth To 'Moderate'-

U.S. house prices grew 11% in 2004, the fastest rate in 25 years.If you exclude Food and Energy, there's no fears about inflation. Food and Energy are my two main expenditures, besides housing. US home prices went up 11% in 2004. That's probably not in the CPI either....snip...

Federal Reserve Governor Ben Bernanke said Thursday the growth of U.S. house prices is likely to slow in the future to a pace that resembles the rate of "return on stocks and bonds."

Here's what Beranke wants to keep quiet:

He and his gang and Kudlow can talk all they want about "no inflation", but this chart shows a different story.

Mover Mike

Sen. Clinton

Senator Hillary Rodham Clinton on Wednesday sharply criticized the sex and violence in video games and other entertainment directed at children, calling the prevalence of such images an epidemic.We might add, an epidemic of movies biased against our culture, anti-business, pro-abortion and pro-lib.

Mover Mike

Wednesday, March 09, 2005

Yellowstone and T-Bonds

The drama Supervolcano is broadcast in two parts, on BBC One on Sunday 13 March and Monday 14 March. Both transmissions are at 2100 GMT. Two science documentaries called Supervolcano: The Truth About Yellowstone are broadcast after the drama, on BBC Two. Again, these air on Sunday and Monday but at the later time of 2200 GMTI hope this two part series will be carried on Comcast in Portland. Yellowstone is a supervolcano and many, here and here, have predicted its eruption, soon.

Mover Mike

Over at Kudlow's Money Politic$, I posted a comment:

Larry, if you still think there is no inflation problem, you ought to look at today's T-Bond. It took a big hit. Seems some are worried, maybe you should be, too.KarmiCommunist said...

Mover Mike

T-Bond?!? Is that like Social Security??? Anyway, i am not sure what it is, but is this it???So Karmi, my point is this: The chart you pointed to is a chart of Treasury Bond (30 Year) yields going back to 1977. The highest interest rate on T-Bonds was an incredible 15%+ on government paper. Inflation was in double digits. We have since then been in a bull market in bondsand yields dropped all the way down to 4 1/4% in 2003. Lower interest rates also benefited the stock market. Price/Earning ratios are based in part on interest rates.

If so, then T-Bone has been dropping since about 1982.

"Inflation"...dig this, from Strategic Forecasting: "U.S. interest rates already are the highest out of the three major

economies, and the Federal Reserve has made no secret of its intention of pushing them higher still despite inflation's being in check."

i'm probably missing you point...sorry, Mover Mike, if my questions offend you.

Karmi

Basically, the lower the interest rates the higher the market, or at least that has been our history since 1980. Ny point of the comment, is that things are changing, signaled by the CRB going to a 24 year high, and now today T-Bonds appear to have completed a large top. Then the dollar has been very week, falling from 112 in 2001 to 81.5 today. The Euro in 2000 was cost .82 to the in USD and now it costs about 1.34 to the in USD. When foreign holders of our currency get nervous, they sell and that drives up interest rates. So now look at the chart of T-Bonds today:(This is a chart of the bonds, not yields, remember when bonds go down, yields go up)

Go back to Karmi's chart, print it out, and draw a straight line connecting as many peaks as you can. My conclusion is that the great trend we have been enjoying, refinancings at lower and lower interest rates, lower credit card interest rates, car loan rates, etc. is coming to an end. Kudlow disagrees with me. He doesn't see inflation. IMO, The Fed can raise short term rates, but can't effect long term rates. Only inflation expectations can raise long rates. I'm seeing all the signs of another inflation cycle, one, before it's over, will see Gold sell at or above the Dow Jones Average!

Mover Mike

Antipode Earthquakes?

Linda Moulton Howe asks scientists about a relationship and about the antipode theory; a theory that a major earthquake on one side of the world can trigger an earthquake on the opposite side.

Another fascinating subject is "Pole Reversal" and here Earth Magnetic Field Reversal is an excellent article on theories about the core of the earth and its effects on tectonic plates.

Mover Mike

I'm seeing the USD breaking down today, and the CRB has gone up 32 straight points without correction, the biggest move at least since 2001 and at a 24 year high. Gold, also, seems to have broken out and is trading above $441 USD and Oil is now over $55 per barrel.

Mover Mike

Welcome and "Truth"

Barcepundit (English edition) - From Barcelona, Spain

Bogs Doddy - From Aussie land

Fine? Why Fine? - a New Yorker, Occupation: Fraud Investigator

The Hobbesian Conservative - The blog for those conservatives who share some libertarian leanings, but cannot muster the undying faith in mankind that a proper libertarian must have.

Lowreview.com - while the law may be passionless, it certainly isn't humorless…at least not to us.

Mover Mike

In NPR Ombudsman talking about the culture, some conservatives are increasingly worried about losing the culture war, despite Republicans in charge. Liberals are frustrated over the re-election of President Bush.

These listeners feel that the media was unwilling or unable to stop Bush's ascent to victory.Have today's journalists thought of themselves as modern "muckrakers" and have we all felt that the job of the media was to shine the light of truth on our favorite problem or cause, thus changing its direction? I would like to think there is an objective "truth" or reality, however I'm beginning to believe that, like quantum mechanics, an object's "truth" is affected by the observer.

Mover Mike

Tuesday, March 08, 2005

McCain

We all know, or should know, that money given in the quantities needed for today's campaigns comes with strings or demands for influence.

Mover Mike

Is this another corrupt politician? Blogs of War posts about Rep. Phil King Attempts to Ban Free Internet Access. Guess who is getting money from the Telecom industry?

Mover Mike

China arms embargo

Europe, in a move led by France and endorsed by Britain, plans to lift the China arms embargo in place since 1989, as a result as a result of the Tiananmen Square Massacre.Mover MikeWe could be engaged with China in a war over Taiwan in the South China Sea... and facing European military technology, bought for the express purpose of sinking American ships and killing American troops.

Oil

...Chavez, a fierce critic of Washington, has made clear he wants to diversify his country's overseas energy ties to reduce its economic dependence on the American market.

Mover Mike

In Richard Russell's Dow Theory Letter (by Subscription only), I was amazed to see that Jet-A (the normal jet fuel, basically a slightly more refined form of kerosene, much cruder than either auto or aviation gasoline), historically, contract (discount) has sold for less than car gas and less than AvGas (100 low-lead aviation gasoline).

Today, it is almost impossible to find Jet-A for under $3.00 per gallon, and $3.50/gallon is typical in the Bay Area. At a high-rent airport, such as SFO, they are charging over $5.00/gallon! Considering that planes using Jet-A typically take on hundreds, or even thousands, of gallons at a time, this is a truly staggering increase in a short period of time, far greater than the increase in the cost of a barrel of NY crude. And the price of Jet-A is now much higher than either AvGas or car gas.I checked with Flightcraft here in Portland and found the same thing: Jet-A at $4.07 per gallon and AvGas at $3.82 per gallon. Again a huge increase over last year. Consider how much FedEx, UPS, and DHL use, I would expect, if they are able to pass on the increase, that using those services is going to cost more and once again a sign that inflation is greater than our government lets on.

Mover Mike